The complete debits and credit ought to equal each other in order that the accounting equation will at all times steadiness. The accounting equation is the bedrock of the double-entry bookkeeping system. Each enterprise transaction journalized via double entry system will affect the accounting equation.

These accounts usually have credit score balances which are elevated with a credit entry. The next time you strategy your steadiness sheet, it’s necessary to remember that debits and credits are the invisible arms preserving every little thing in stability. By understanding their roles, you can confidently manage your cash to make strategic selections that set your small business on the trail to lasting success. Instead of spending time on handbook journal entries and locating errors, use accounting software program like QuickBooks. This may occur should you regulate or reverse the expenses you beforehand recorded.

It summarizes an organization’s property, liabilities, and homeowners’ equity. The balance sheet can be commonly known as the statement of economic position. It’s a debit when a company pays a creditor from accounts payable, decreasing the amount owed.

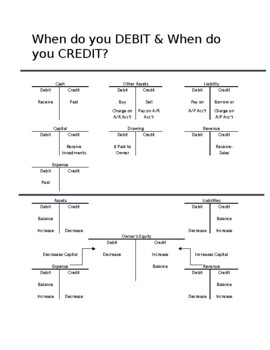

The forms of accounts to which this rule applies are liabilities, revenues, and fairness. Usually, you want to credit score the account representing an item that’s leaving your business. Thus, a cash payment translates right into a credit score to your money account.

What Is The Appropriate Rule Of Debits And Credits?

We focus on monetary assertion reporting and don’t focus on how that differs from revenue tax reporting. Due To This Fact, you want to always consult with accounting and tax professionals for assistance together with your specific circumstances. If an organization pays the hire for the present month, Lease Expense and Cash are the 2 accounts concerned. If a company supplies a service and offers the client 30 days during which to pay, the company’s Service Revenues account and Accounts Receivable are affected. If a company buys supplies for money, its Provides account and its Cash account shall be affected.

For an asset account like your checking account, a debit means cash https://www.simple-accounting.org/ is coming in. For a legal responsibility account like a loan, a debit means you’ve paid cash out, lowering what you owe. When recording transactions in your general ledger, a debit decreases a income account, and a credit score will increase a income account. When recording transactions in your books, a debit decreases an equity account, and a credit score will increase it.

Steadiness Sheet Method

In this case, the $1,000 paid into your money account is classed as a debit. These definitions become essential when we use the double-entry bookkeeping technique. With this approach, you submit debits on the left aspect of a journal and credit on the right. The whole dollar amount posted to each debit account must be equal to the whole dollar quantity of credits. Accounting, at its core, is a language – a structured system for speaking the monetary well being and efficiency of a corporation. And like any language, it has its own unique grammar and vocabulary.

- They are used to alter the ending balances in the general ledger accounts when accrual foundation accounting is used.

- Expense accounts are just one type of account that companies use to maintain observe of their finances.

- The stock of a manufacturer should report the price of its raw materials, work-in-process, and completed goods.

- For each transaction, you’ll must report each a debit and a corresponding credit score in two different accounts.

Examine our enterprise checking solutions that will help you discover the proper checking account for you. To discover imbalances, search for a transaction that’s half the value of the imbalance. You might have accidentally posted a debit as a credit score or vice versa. These errors double the size of the error in financial terms.

Put very simply, debits (dr.) at all times go within the left column of a t-account and credit (cr.) always go in the best column. Income must be recorded when it’s earned, not necessarily when fee is acquired, aligning transactions with the reporting period and presenting a real monetary position. Liabilities typically have the word “payable” in the account title. Liabilities also embrace amounts received in advance for a future sale or for a future service to be carried out. An income assertion account for expense objects which are too insignificant to have their own separate basic ledger accounts.

Before we clarify and illustrate the debits and credit in accounting and bookkeeping, we will discuss the accounts by which the debits and credit will be entered or posted. Managing debits and credit by hand can take up lots of time and depart room for errors. That’s why accounting software program is so useful; it handles both sides of your transactions with only a few clicks. Spending cash, promoting stock, or customers paying down their money owed are all examples of credit since these sources are leaving your organization. The debit increases the tools account, and the money account is decreased with a credit.

Beneath the accrual basis of accounting, the Interest Revenues account reviews the interest earned by an organization through the time interval indicated in the heading of the earnings statement. Curiosity Revenues account contains interest earned whether or not or not the interest was acquired or billed. Curiosity Revenues are nonoperating revenues or earnings for firms not within the enterprise of lending cash. For firms in the enterprise of lending money, Interest Revenues are reported within the working part of the multiple-step earnings assertion.